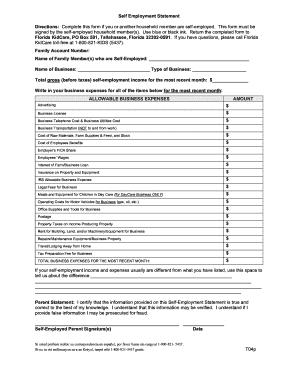

Get the free self employment letter for food stamps form

Get, Create, Make and Sign

How to edit self employment letter for food stamps online

How to fill out self employment letter for

How to fill out self employment letter for:

Who needs self employment letter for:

Video instructions and help with filling out and completing self employment letter for food stamps

Instructions and Help about peachcare tax form form

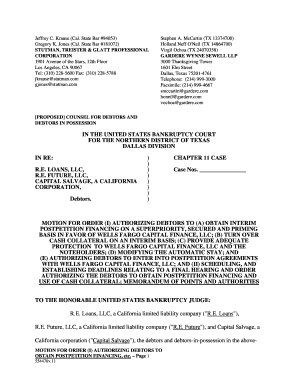

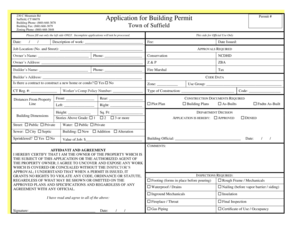

Welcome to self-employment this is lesson 2, and we are going to look at the income that you make if you are self-employed as well as the additional taxes that you might end up owing our objectives today are to understand what is self-employment income to understand and calculate self-employment tax and understand what tax forms are required to be used for self-employment income as well as the taxes associated with that so what are self-employed individuals these are individuals who are independent contractors they're not employees as somebody else so if you go out, and you babysit for example you are a self-employed individual if you go around your neighborhood and you cut lawns for people shovel snow you're considered to be a self-employed individual there's obviously varying levels of self-employed individuals ranging from a babysitter all the way up to somebody who actually does run and owned a business and has their own employees we're a self-employment or self-employed income expenses that profit and taxes reported well we haven't looked at the form 1040 yet but if you have a business that's owned by just one person these are always reported on Form 1040 but first organized and set up on Schedule C if you have a business that has profit most likely you'll have to pay self-employment taxes for this business those are calculated and reported also on 1040, but they come over from a Schedule S II where they are organized and the tax is calculated when you work for somebody else as an employee you pay Medicare and Social Security your employer also pays Medicare and Social Security on you so whatever you pay your employer matches that when you have your own business you have to pay both portions and that's what Schedule SE calculates for you so what are some examples of self-employment expenses when you have a business you keep track of your income, but then you also get to keep track of all of your expenses those expenses deduct directly from your income to give you a net profit well some examples would be advertising you may have to advertise for your business you may have to drive around and have car and truck or travel expenses you might have separate insurance pay interest on loans that you have for equipment legal fees office expenses supplies you may even have to rent things, so it's really important that if you do have your own business that you keep track of all the expenses that you incur related to that business because those expenses are directly deductible against the income if you think about how much tax you're going to have to pay you won't have to pay tax on your gross income you'll pay tax on your net income so your total income plus all your expenses how would a self-employed net profit impact overall income in taxes well self-employment profit ultimately increases the income that you have that subject to tax think of it as from a job the amount of income you have is taxed as usual self-employment loss however will decrease...

Fill self employment form peachcare for kids : Try Risk Free

People Also Ask about self employment letter for food stamps

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your self employment letter for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.